Thursday, May 19, 2016

Insurance Companies Join the Fight Against Opioid Epidemic

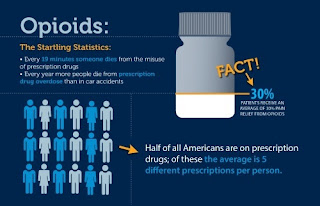

Health insurance companies are now joining the fight against Opioid addiction. Cigna, a health insurance firm that insures about 14 million Americans, is the newest major health insurance provider to fight the staggering opioid addiction numbers and deaths. The company is targeting what experts are saying the number one cause of the addiction, over-prescribing of prescription painkillers like oxycodone, hydrocodone and morphine.

Other insurance companies like Aetna and Blue Cross Blue Shield have also taken similar steps over the past several years to prevent deaths and pull down the numbers of people who get addicted to this drugs. It doesn't just save a lot of people, it also makes good business sense. According to research, it cost public and private insurance companies about $72.5 billion annually to deal with prescription painkiller abuse, treatment and “diversion” (when patients sell the medication instead of taking it).

Big health insurance companies do have access to prescription information for its customers. The have records every-time their customer fill a prescription using their insurance. Cigna’s new measure will be to flag customers who are deemed high-risk — either for getting large amounts of opioid medicines, for getting narcotics from different doctors or for being on the medicines for a long time and they will contact with those customers’ doctors.

The doctor can give their patients other treatment options if addiction is an issue. If the doctor feels the patient still needs to be prescribed long-term narcotics, Cigna can limit where the patient is able to pick the medicine up and which doctors are able to prescribe narcotics to them, so that the doctor is able to closely monitor whether that patient seems to be needing more and more painkillers.

Cigna is targeting to lessen the number of opioid prescriptions written to its customers by 25%, back to the number of prescriptions that were being written in 2006, which the insurer calls “pre-crisis.”

Monday, May 9, 2016

Smartphone Insurance 101

Smartphone are expensive and easy to lose, break or stolen, this is why smartphone or cellphone insurance is in demand nowadays. Smartphone insurance covers lost, stolen or damaged phones. However, you should take note of the following information about this kind of insurance:

1. Deductible can be as much as the cost of the smartphone - iPhone 6S with a 2-year contract from Sprint is priced at $199.99. The Sprint’s Total Equipment Protection insurance costs $11 per month. Unfortunately for you if you lost or break your smartphone the insurance deductible will be $200.

This happens since carriers heavily subsidize smartphone prices if you purchased it with a contract. The retail price for an iPhone 6S is about $650. Installment plans, which often require no upfront payment for the phone, they simply spread its cost out over your contract term.

2. The Insurance Company will Determine the Replacement Smartphone - Your insurance company will have the final say on the replacement smartphone it may be of the same make and model, it maybe of different color or type. It may also be refurbished.

3. Carrier companies can dropped you from your plan for making a claim - Most insurance providers limits customers to two claims in a 12-month period. This can be a problem for people that are particularly accident-prone. The trouble is, those are the people for whom cellphone insurance makes the most sense.

Here are Cellphone protection plans:

AT&T -

Monthly fee: $7.99.

Deductible: $50-$199, depending on device. They offer declining deductible program that can give you 25% to 50% less.

AppleCare+ -

Cost: $99-$129 for two years of coverage.

Covers: Damage (two incidents) and phone malfunctions.

Deductible: $79 or $99 per incident, depending on model.

T-Mobile -

Monthly fee: $10.

Deductible: $20-$175.

Sprint -

Monthly fee: $9-$11

Deductible: $50-$200, depending on device.

SquareTrade -

Cost: $119 for two years of coverage.

Covers: Damage and phone malfunctions.

Deductible: $99 for all claims.

Verizon -

Monthly fee: $7.15 (smartphones), $5 (basic phones, tablets).

Deductible: $99-$199 (smartphones), $49-$199 (basic phones, tablets).

Subscribe to:

Posts (Atom)