Tuesday, August 27, 2013

Zurich Insurance Finance Chief Wauthier Found Dead

Zurich Insurance Group AG (ZURN), the biggest Swiss insurer, announced that their Chief Financial Officer Pierre Wauthier,53 was found dead at his home yesterday.

Police officers are investigating how he died, the company said in an e-mailed statement late yesterday. They declined to disclose further details. Officials found no indications of third-party involvement in the death, Marcel Schlatter, a police spokesman said.

“The board of directors, group executive committee and all of our colleagues are deeply saddened and pass on our condolences to the family and relatives,” Chief Executive Officer Martin Senn said in the statement.

The police ordered an autopsy to determine the cause of death, according to Schlatter. He said that Wauthier lived in Walchwil, a municipality with about 3,591 residents on the eastern shore of Lake Zug.

KPMG, JPMorgan

Wauthier, who held a master’s degree in international finance from l’Ecole des Hautes Etudes Commerciales and a Masters in private law from the Sorbonne University in Paris, began his career at KPMG in 1982, according to Zurich Insurance’s website. He worked for two years at the French Ministry of Foreign Affairs and joined JPMorgan Chase & Co. (JPM:US) in 1985, before taking on the job at Zurich Insurance.

Zurich Insurance, based in Zurich, said on Aug. 15 that floods in central Europe and tornadoes in the U.S. contributed to a 27 percent decline in second-quarter net income to $789 million, missing analysts’ estimates.

The shares fell 1.8 percent to 239 francs by 10:48 a.m. in Zurich, valuing the company at 35.4 billion francs ($38 billion).

Tuesday, August 20, 2013

States foresee more insurance customers

WASHINGTON — USA TODAY made a survey and shows that from the 19 states operating health insurance exchanges to help the uninsured find coverage, at least 8.5 million will use the exchanges to buy insurance. That would far outstrip the federal government's estimate of 7 million new customers for all 50 states under the 2010 health care law.

USA TODAY contacted the 50 states, and 19 had estimates for how many of their uninsured residents they expect will buy through the exchanges. About 48 million Americans were uninsured in 2011, according to the Kaiser Family Foundation.

Under the law, also known as the Affordable Care Act, people without health insurance provided by their employers, the government or their parents will have to buy insurance on the exchanges, which are websites where they can compare prices and choose policies. They will pay a fine if they decline to buy the insurance.

To stay financially viable, insurers need healthy people to help round out the costs of those with chronic conditions. The non-partisan Congressional Budget Office did its own research to determine 7 million people would enroll for the 2014 exchanges.

California alone said it expected to sign up 5.3 million people.

To diversify the health of the pool, the Department of Health and Human Services has targeted three states where half of uninsured people ages 18 to 35 live: Texas, Florida and California.

The states said they made their estimates based on how many individuals are uninsured and aren't likely to become insured by an employer, what insurers in their states expect and conversations with HHS about reasonable goals.

Source: USA Today

USA TODAY contacted the 50 states, and 19 had estimates for how many of their uninsured residents they expect will buy through the exchanges. About 48 million Americans were uninsured in 2011, according to the Kaiser Family Foundation.

Under the law, also known as the Affordable Care Act, people without health insurance provided by their employers, the government or their parents will have to buy insurance on the exchanges, which are websites where they can compare prices and choose policies. They will pay a fine if they decline to buy the insurance.

To stay financially viable, insurers need healthy people to help round out the costs of those with chronic conditions. The non-partisan Congressional Budget Office did its own research to determine 7 million people would enroll for the 2014 exchanges.

California alone said it expected to sign up 5.3 million people.

To diversify the health of the pool, the Department of Health and Human Services has targeted three states where half of uninsured people ages 18 to 35 live: Texas, Florida and California.

The states said they made their estimates based on how many individuals are uninsured and aren't likely to become insured by an employer, what insurers in their states expect and conversations with HHS about reasonable goals.

Source: USA Today

Tuesday, August 13, 2013

White House Reaffirms Housing Importance for Consumers and Government's Role in Protecting Middle Class Renters and Homeowners

President Obama outlined a coordinated set of initiatives to build on the housing economy’s emerging recovery which is an important step in reaffirming housing’s importance to American consumers, whether they are renters or owners.

Consumer Federation of America said in a statement released after the speech in Phoenix, AZ: “Access to sustainable, affordable home finance has been a fundamental supporting pillar of the American dream,” said Barry Zigas, CFA’s Director of Housing Policy. “President Obama’s speech reaffirmed that fact. The policies he outlined are important, positive steps that will help Americans build economic and family security through a strong and resilient housing economy.”

Importantly, Zigas noted, Obama’s speech recognized that while the overall economy shows steady improvement, and housing prices have stabilized or even increased significantly in many markets, millions of American homeowners remain mired in the wreckage left by a spree of unregulated, unscrupulous speculation and reckless behavior by Wall Street banks, mortgage brokers and investors. The speech promised much needed continuation of existing rescue programs like HAMP and HARP, and increased focus on spending the $7.6 billion provided to the so-called “hardest hit states” with the highest rates of home foreclosures.

“The banking system has been too slow to rectify the mistakes that led to the financial crisis,” Zigas said. “We applaud the fact that more than 1 million homeowners have received mortgage modifications under HAMP, and several million more reduced their mortgage payments through refinancing into lower interest rates. But much more remains to be done, and today’s speech gives those families renewed hope that help is on the way.”

The speech also focused on the high rent burdens facing increasing numbers of renters, including middle income wage earners. Families’ ability to save for important life events, including education, retirement and the down payment for a home is compromised if their rent eats up most of their paycheck.

“The Low Income Housing Tax Credit and rental assistance programs are critically important in our current economy, where stagnant wages and persistent under-employment challenge even the most dedicated housing developers,” Zigas said. “Support for existing programs, and expanding them, even in a constrained budget environment, is an investment in critical economic and social infrastructure.”

Access to Mortgage Credit

Millions of consumers today are locked out of mortgage financing because lenders and Fannie Mae and Freddie Mac have reacted to the mortgage crisis by going too far in restricting credit. The President’s call for clarity in underwriting and credit decisions is important, but needs to be accompanied by an equally forceful message to the lending community that the billions of dollars extended by the federal government to restore their balance sheets must be coupled with a commitment by those same banks to help everyday American families with sustainable, affordable loans.

“Credit today is far tighter than it was when homeownership rates were rising and responsible, sustainable credit was available through fully documented, long term fixed rate loans in the 1990’s and early 2000’s,” Zigas said. “Lenders need to get back in the market with those products. Today’s speech is a good step, but this dance requires both partners to get on the floor.”

Mortgage Finance Reform

Today’s speech is the Administration’s first policy proposal on the future of the US mortgage finance system since its White Paper in 2011. That paper outlined a series of options, but did not endorse a specific approach.

“Today’s speech puts the Administration squarely behind the important role that government must play in assuring that consumers of the future enjoy the same access to affordable, sustainable mortgage credit that their parents and grandparents did,” Zigas said. “The President’s announced proposals track closely those of the Bipartisan Policy Center’s housing commission, and proposals made by many organizations in recent years, including CFA,” Zigas noted. (Zigas serves as a member of the BPC housing commission.) “Together with emerging bipartisan proposals like that offered in the Senate by Sens Corker, Warner and their colleagues today’s announcement should accelerate the important work of restoring a durable housing finance structure for US consumers.”

FHFA Leadership

CFA strongly supports the President’s call for swift action on the pending nomination of Rep. Mel Watt to be Director of the Federal Housing Finance Agency (FHFA). “As overseer of the two biggest sources of mortgage financing for consumers today,” Zigas said, “it is long past time when the agency should be led by an appointed and confirmed Director. CFA joins the White House in urging Senate action on the pending nomination.”

Consumer Federation of America said in a statement released after the speech in Phoenix, AZ: “Access to sustainable, affordable home finance has been a fundamental supporting pillar of the American dream,” said Barry Zigas, CFA’s Director of Housing Policy. “President Obama’s speech reaffirmed that fact. The policies he outlined are important, positive steps that will help Americans build economic and family security through a strong and resilient housing economy.”

Importantly, Zigas noted, Obama’s speech recognized that while the overall economy shows steady improvement, and housing prices have stabilized or even increased significantly in many markets, millions of American homeowners remain mired in the wreckage left by a spree of unregulated, unscrupulous speculation and reckless behavior by Wall Street banks, mortgage brokers and investors. The speech promised much needed continuation of existing rescue programs like HAMP and HARP, and increased focus on spending the $7.6 billion provided to the so-called “hardest hit states” with the highest rates of home foreclosures.

“The banking system has been too slow to rectify the mistakes that led to the financial crisis,” Zigas said. “We applaud the fact that more than 1 million homeowners have received mortgage modifications under HAMP, and several million more reduced their mortgage payments through refinancing into lower interest rates. But much more remains to be done, and today’s speech gives those families renewed hope that help is on the way.”

The speech also focused on the high rent burdens facing increasing numbers of renters, including middle income wage earners. Families’ ability to save for important life events, including education, retirement and the down payment for a home is compromised if their rent eats up most of their paycheck.

“The Low Income Housing Tax Credit and rental assistance programs are critically important in our current economy, where stagnant wages and persistent under-employment challenge even the most dedicated housing developers,” Zigas said. “Support for existing programs, and expanding them, even in a constrained budget environment, is an investment in critical economic and social infrastructure.”

Access to Mortgage Credit

Millions of consumers today are locked out of mortgage financing because lenders and Fannie Mae and Freddie Mac have reacted to the mortgage crisis by going too far in restricting credit. The President’s call for clarity in underwriting and credit decisions is important, but needs to be accompanied by an equally forceful message to the lending community that the billions of dollars extended by the federal government to restore their balance sheets must be coupled with a commitment by those same banks to help everyday American families with sustainable, affordable loans.

“Credit today is far tighter than it was when homeownership rates were rising and responsible, sustainable credit was available through fully documented, long term fixed rate loans in the 1990’s and early 2000’s,” Zigas said. “Lenders need to get back in the market with those products. Today’s speech is a good step, but this dance requires both partners to get on the floor.”

Mortgage Finance Reform

Today’s speech is the Administration’s first policy proposal on the future of the US mortgage finance system since its White Paper in 2011. That paper outlined a series of options, but did not endorse a specific approach.

“Today’s speech puts the Administration squarely behind the important role that government must play in assuring that consumers of the future enjoy the same access to affordable, sustainable mortgage credit that their parents and grandparents did,” Zigas said. “The President’s announced proposals track closely those of the Bipartisan Policy Center’s housing commission, and proposals made by many organizations in recent years, including CFA,” Zigas noted. (Zigas serves as a member of the BPC housing commission.) “Together with emerging bipartisan proposals like that offered in the Senate by Sens Corker, Warner and their colleagues today’s announcement should accelerate the important work of restoring a durable housing finance structure for US consumers.”

FHFA Leadership

CFA strongly supports the President’s call for swift action on the pending nomination of Rep. Mel Watt to be Director of the Federal Housing Finance Agency (FHFA). “As overseer of the two biggest sources of mortgage financing for consumers today,” Zigas said, “it is long past time when the agency should be led by an appointed and confirmed Director. CFA joins the White House in urging Senate action on the pending nomination.”

Friday, August 9, 2013

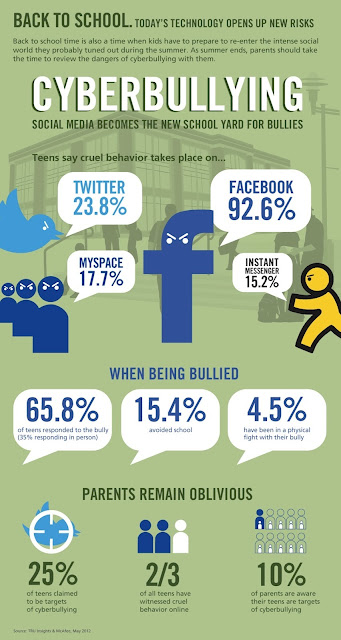

Bullying - Info-graphics

Bullying is a reality that our children face today and it's not just bullying in school but also bullying on the Internet called cyberbullying.

Bullying is the use of force or coercion to abuse or intimidate the victims. It is an unwanted, aggressive behavior. It can be habitual and involve an imbalance of social or physical power.

It may include verbal harassment or threat, physical assault or coercion and may be directed repeatedly towards particular victims, perhaps on grounds of class, race, religion, gender, sexuality, appearance, behavior, or ability. If bullying is done by a group, it is called mobbing. The victim of bullying is sometimes referred to as a "target".

Bullying behaviors happen more than once or have the potential to happen more than once.

Check out these info-graphics on bullying:

Subscribe to:

Posts (Atom)