Thursday, January 22, 2015

Disneyland Hit by measles outbreak

Will you bring your kids to Disneyland where there's a measles outbreak? I guess not. Last December a guest with measles may have visited the park in California and may have pass it to other guest when he/she sneezed. It seems that a lot of people in California don't have measles immunization.

According to a news report 70 people have now been infected by the measles outbreak, and public health officials is advising the public to get measles immunization vaccine. They also warned children under 12 and anyone not vaccinated to avoid Disney parks where the outbreak originated.

Centers for Disease Control and Prevention said, “Measles is so contagious that if one person has it, 90% of the people close to that person who are not immune will also become infected.” People who are infected with the disease can spread measles to others from 4 days before to 4 days after the rash appears.

The outbreak has now spread to 5 U.S. States and Mexico, and new infections has emerged last Wednesday with the total infected is now at 70, which includes 5 Disney employees who have since returned to work. 62 of those who are infected are in California.

People at highest risk are those who are not vaccinated, pregnant women, infants under 6 months old, and those with weakened immune systems. Many Americans don't have this immunization since some says that there is a link between the vaccine and autism.

Saturday, January 17, 2015

State of the Union Address: Obama Wants to Raise Taxes on Wealthy to Finance Tax Credits

President Obama wants to increase taxes on top earners which will include investment tax rates so that the government can fund new tax credits and other measures that he thinks will help the middle class. Included in his proposal is the removal of tax break on inheritances.

He will have a hard time with this since the Republican-controlled Congress are opposed to any tax raise since they claim that any tax increase will negatively affects economic growth at a time the U.S. cannot afford it.

Whitehouse believes that the new tax raise if implemented would raise $320 billion over the next decade, while adding new provisions cutting taxes by $175 billion over the same period. It will also fund the free community college for 2 years that is expected to cost $60 billion over 10 years.

Obama wants to end the “trust-fund loophole” on inheritances that save billions of dollars from taxation yearly. This will require estates to pay capital gains taxes on securities at the time they're inherited. It would also raise the top capital-gains tax rate to 28% (from 23.8%) for family with an annual income of above $500,000. Banks with assets over $50 billion will be taxed and the fund will be used to finance tax incentives for middle-income earners, which includes $500 credit for families in which both spouses work, additional child care and education credits and incentives to save for retirement.

Republican leaders said they also wanted to reform the country's complicated tax code, however they don't agree with most of the proposals the president will outline on Tuesday. For example, most Republicans want to lower or eliminate the capital gains tax and similarly want to end taxes on estates, not expand them.

Republicans support the fee on the banks with more than $50 billion assets. This new fee is the same proposal from former Republican Rep. Dave Camp of Michigan, who led the tax-writing Ways and Means Committee. Camp's plan, however, was part of a larger proposal to lower the overall corporate income tax rate.

If it would help the working middle-class and not the lazy-class, I'm all for it.

Wednesday, January 7, 2015

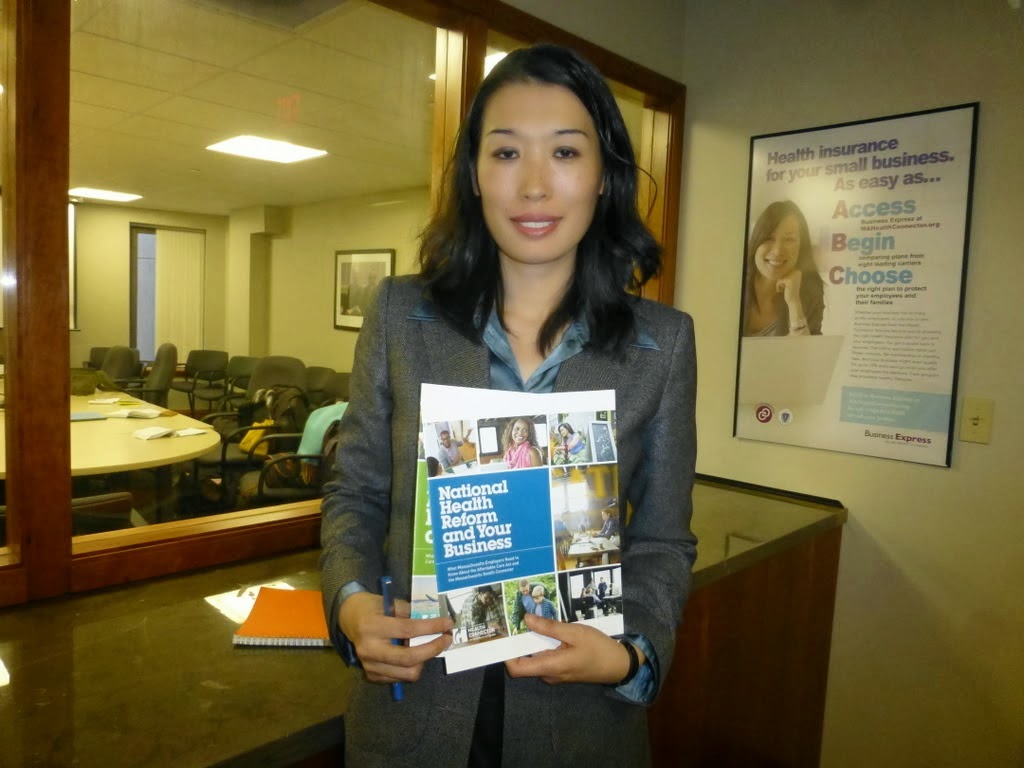

Jean Yang Executive Director Of MA Health Connector Quits

Jean Yang the Executive Director of the Massachusetts Health Connector quits after a very difficult year in which the state's health care exchange failed in spectacular fashion and fall far behind the federal site when in comes to fixing the problem. Her departure was expected since there is a new Republican governor, Charlie Baker, who is about to take office.

The problems in the connector's website impaired the process of transition from Massachusetts’(1st in the US) universal healthcare insurance law to the requirements of the Affordable Care Act, that left hundreds of thousands of people in the temporary Medicaid coverage.

Maydad Cohen, will took office as interim executive director until the Baker administration appoints a successor.

Subscribe to:

Posts (Atom)